Checking Out the Relevance of Construction Accountancy in the Building And Construction Industry

The building market runs under unique financial difficulties that demand a specific strategy to accountancy. Building and construction accounting not only guarantees the precision of monetary coverage yet additionally plays a crucial role in project management by allowing efficient task setting you back and source appropriation. By understanding its key concepts and benefits, stakeholders can considerably influence project end results. The intricacies intrinsic in building accountancy raise questions about ideal methods and the tools available to manage these intricacies properly. What approaches can building and construction firms execute to optimize their financial procedures and drive success?

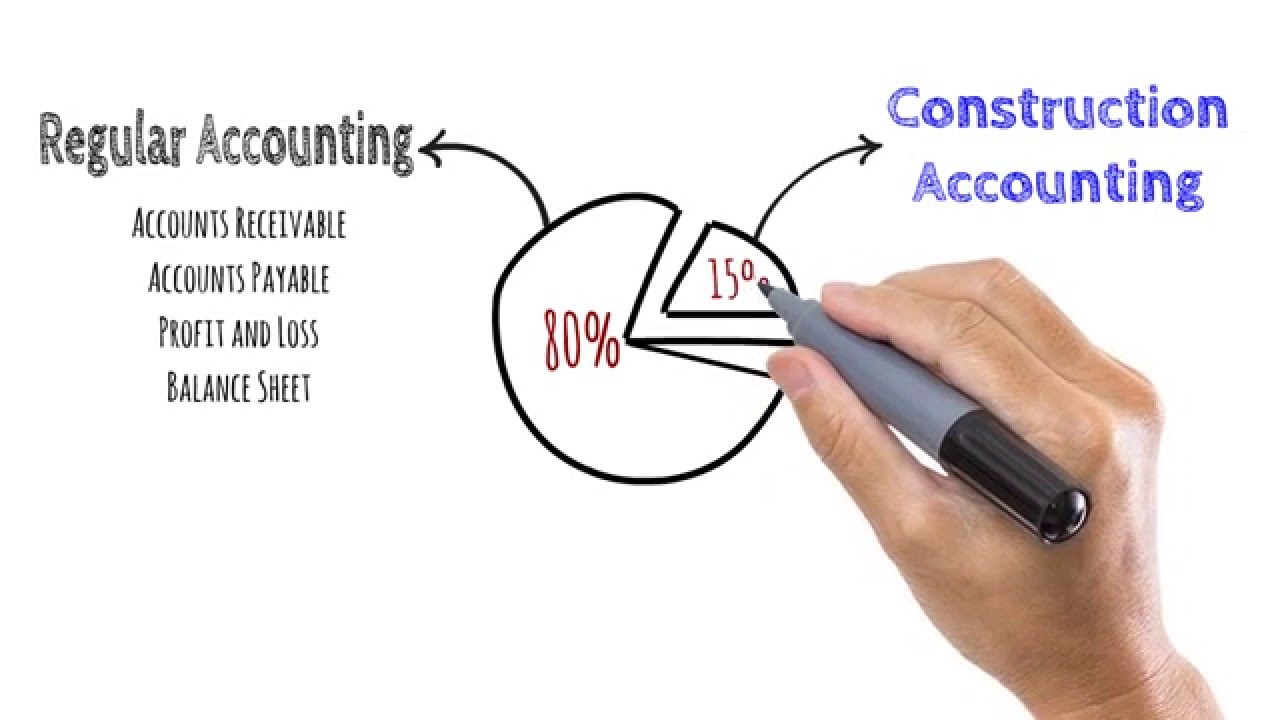

Special Challenges of Construction Accountancy

Frequently, building and construction accountancy presents special difficulties that distinguish it from various other sectors. One key difficulty is the complex nature of building and construction jobs, which typically involve numerous stakeholders, changing timelines, and varying laws. These elements demand meticulous tracking of prices associated with labor, materials, tools, and overhead to preserve task profitability.

One more substantial challenge is the requirement for exact job costing. Building firms must assign prices to specific projects precisely, which can be tough as a result of the long duration of jobs and the possibility for unforeseen expenses. This demand needs durable audit systems and techniques to ensure timely and exact economic coverage.

Additionally, the building sector is vulnerable to transform orders and contract modifications, which can additionally complicate monetary monitoring and projecting. Appropriately representing these adjustments is important to prevent disputes and ensure that projects remain within budget plan.

Key Concepts of Building And Construction Bookkeeping

What are the foundational concepts that lead construction accounting? At its core, building accounting rotates around precise monitoring of costs and revenues associated with details tasks.

Another key principle is the application of the percentage-of-completion technique. This technique recognizes income and costs proportionate to the project's progression, giving a much more realistic sight of financial efficiency in time. In addition, construction accounting emphasizes the importance of conformity with audit standards and regulations, such as GAAP, to guarantee transparency and integrity in economic coverage.

Furthermore, cash circulation monitoring is crucial, given the typically cyclical nature of building tasks. These concepts jointly create a durable framework that sustains the distinct monetary demands of the construction market.

Benefits of Efficient Construction Accounting

Effective building and construction audit supplies countless benefits that considerably boost the overall administration of projects. Among the key advantages is improved economic visibility, making it possible for project supervisors to track costs properly and monitor cash circulation in real-time. This transparency promotes informed decision-making, lessening the threat of budget plan overruns and guaranteeing that resources are alloted effectively.

In addition, reliable building bookkeeping improves conformity with regulatory needs and industry standards. By keeping exact financial documents, firms can conveniently give paperwork for audits and fulfill legal commitments. This persistance not only promotes trust fund with customers and stakeholders yet additionally alleviates possible legal threats.

In addition, effective audit techniques add to far better task forecasting. By analyzing previous efficiency and monetary fads, building and construction companies can make more accurate predictions concerning future job prices and timelines. construction accounting. This capacity improves tactical planning and makes it possible for firms to react proactively to market changes

Tools and Software for Building And Construction Accountancy

A range of specialized tools and software program options are offered for construction audit, each created to improve financial monitoring processes within the industry. These devices help with monitoring, reporting, and examining financial information particular to construction tasks, guaranteeing precision and compliance with sector requirements.

Leading software choices include integrated construction administration platforms that include project administration, budgeting, and bookkeeping capabilities. Solutions such as Sage 300 Construction and Property, copyright for Professionals, and Point of view Vista offer features tailored to manage work costing, pay-roll, and invoicing, making it possible for construction firms to keep specific financial oversight.

Cloud-based applications have actually obtained appeal due to their availability and real-time cooperation capabilities. Tools like Procore and CoConstruct allow teams to accessibility economic information from multiple places, enhancing interaction and decision-making procedures.

In addition, construction bookkeeping software application often supports compliance with regulative demands, assisting in audit routes and tax obligation coverage. The assimilation of mobile applications more boosts functional performance by permitting area employees to input information straight, lowering mistakes and delays.

Finest Practices for Building And Construction Financial Monitoring

Successful construction audit counts not only on the right devices and software program however also on the execution of finest practices for economic why not find out more management. To attain efficient financial oversight, building and construction companies should focus on routine and exact job budgeting. This procedure includes damaging down job prices into thorough classifications, which enables much better monitoring and forecasting of expenditures.

Another essential method is keeping a durable system for invoicing and capital management. Prompt invoicing ensures that settlements are received immediately, while diligent money circulation monitoring assists protect against liquidity issues. Furthermore, construction companies must take on a rigorous technique to work costing, examining the real prices against budgets to recognize variances and adjust approaches accordingly.

Furthermore, promoting transparency with detailed economic coverage boosts stakeholder trust fund and help in educated decision-making. Normal economic testimonials and audits can additionally reveal possible inadequacies and locations for renovation. Last but not least, continual training and growth of monetary administration skills among staff guarantee that the team remains experienced at browsing the intricacies of building bookkeeping. By incorporating these ideal methods, construction companies can improve their financial security and drive job success.

Final Thought

In final thought, visit this website building and construction accountancy functions as a basic component of the building and construction industry, attending to unique obstacles and adhering to crucial principles our website that boost financial precision. Reliable bookkeeping techniques yield considerable benefits, consisting of boosted capital and conformity with governing standards. Using ideal tools and software application further supports monetary monitoring efforts. By carrying out ideal practices, building companies can cultivate stakeholder trust and make notified choices, inevitably adding to the general success and sustainability of jobs within the sector.

Building bookkeeping not only makes sure the accuracy of monetary reporting but also plays a critical role in project management by enabling reliable work setting you back and source appropriation. In addition, building bookkeeping highlights the importance of compliance with audit criteria and guidelines, such as GAAP, to guarantee transparency and integrity in monetary reporting.

Successful building and construction accountancy depends not only on the right devices and software application but additionally on the execution of finest practices for economic administration. Continuous training and development of economic administration abilities amongst team guarantee that the group remains experienced at navigating the complexities of building bookkeeping.In verdict, construction accountancy serves as a basic element of the construction market, addressing special challenges and sticking to key concepts that enhance monetary precision.